Take charge of your credit

Transfer an existing Canadian credit card balance to your new Servus Mastercard and receive a special introductory 3.99% interest rate for 10 months, with a 1% balance transfer fee* of the amount advanced or a $7.50 minimum fee, whichever is greater.

Did you know that this introductory interest rate offer also applies to a Funds Transfer? Move available credit from your Servus Mastercard into your Servus daily banking accounts to give you access to immediate cash flow.

Why transfer a balance?

A balance transfer can help you pay off your outstanding credit card balances faster, helping you to pay off your debt faster and save on interest charges.

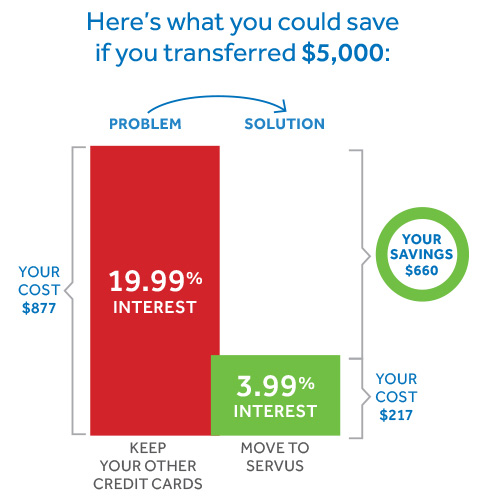

Cost comparison is based on interest accumulated over a 10 month limited promotional period on a $5,000 balance/funds transfer at the promotional annual interest rate of 3.99%, plus a balance/funds transfer fee equal to 1% of the amount advanced/transferred. This comparison assumes that only a minimum payment of $10 is made in each billing cycle for the applicable credit card account over that 10 month limited promotional period and that no other transactions are posted to the credit card account during that 10 month limited promotional period.

You could save over $600 in interest charges on a $5,000 balance transfer! That's money you can use to pay off your balance before the special rate expires.

Transfer a balance

To qualify for a balance transfer with the special interest rate, you must:

- Apply within 30 days of receiving your new Servus Mastercard

- Activate your new card

To request a balance transfer:

- Call us at 1.877.378.8728

- Visit your local branch

- Complete the "Transfer a balance" form in online banking

The balance transfer you request will appear on your Servus Mastercard account within 3-5 business days.

Balance Transfer/Funds Transfer Frequently Asked Questions

How can a balance transfer/funds transfer help my finances?

There are a few ways a balance transfer/funds transfer can help your finances:

- Reduce high-interest credit card debt. If you’re paying high interest rates on store cards (e.g. 29.99% or more), or even average credit card interest rates (e.g. 19.99%), a balance transfer gives you the chance to potentially save hundreds of dollars in interest fees during a 10 month limited promotional period. When you’re paying less interest, you can pay off your principal balance faster or save more for your other financial goals.

- Increase cash-flow in an emergency. With a funds transfer, you can move available credit from your Servus Mastercard into your Servus chequing or savings account, giving you access to cash when you need it at a low interest rate for 10 months.

- Improve debt management. A balance transfer makes it easier to track your total outstanding credit card balances by consolidating multiple card balances into one, easy-to-read statement.

When do I start paying interest on my balance transfer/funds transfer?

Interest will be charged starting on the day the transfer amount is posted to your Servus Mastercard account and continues until the balance transfer or funds transfer amount is paid in full. Unlike a purchase, there is no interest free grace period for balance transfers or fund transfers.

What happens to my interest rate after 10 months?

At the end of the ten month period, the interest rate that will apply on any remaining amount of the balance transfer or funds transfer will increase to the same rate of interest that applies to balance transfers and cash advances under your Servus Mastercard Account which is currently 12.99% for the Low Rate Card and 25.99% for the No Fee/Low Fee/Gold/Platinum/World Elite.

Are there any other fees for my balance transfer/funds transfer?

All balance/funds transfers are subject to a fee equal to the greater of (i) 1% of the amount of the balance /funds transfer, and (ii) $7.50.

The fee is applied to your account on the day the transfer is posted to your Servus Mastercard account. The same interest rate applies to the balance/funds transfer fee that applies to as the balance/funds transfer under this offer: 3.99% for the first 10 months, and after that, the same rate of interest that applies to balance transfers and cash advances provided that you make your minimum payment due on your Servus Mastercard Account during the 10 month promotional period.

How much can I transfer?

You can transfer any amount you like up to the available credit limit (less the balance transfer/funds transfer fee) on your Servus Mastercard account less any outstanding balance.

* You can request a balance transfer on your non-Servus Credit Union credit card or a transfer of funds from your Servus Mastercard Account (your “Account”) to your Servus chequing or savings account in an amount (including the transfer fee) that does not exceed your current credit limit (taking your outstanding balance into account). Any transfer made under this offer will be treated as a balance transfer/cash advance under your Servus Mastercard Account Agreement and, except as otherwise provided for in this offer, will be subject to the terms and conditions of that Agreement. The balance/funds transfer amount and the transfer fee will be charged to your Account at a promotional interest rate of 3.99%. Interest will be charged from the date that the transfer is posted to your Account until you repay the total amount that you owe. All balance transfers/funds transfer are subject to a fee in an amount equal to the greater of (i) 1% of the amount of the balance/funds transfer and (ii) $7.50. Please allow 3-5 business days from the time that you verbally accept and consent to this offer for any balance/funds transfer request to be processed. You will be entitled to benefit of the promotional interest rate for the first 11 consecutive billing cycles following the initial posting date of the transfer to your Account. You will lose the benefit of this promotional interest rate and any remaining balances that had the benefit of the promotional interest rate if you miss making your minimum payment due under your Account by the due date. In that circumstance, the balances that were subject to the promotional interest rate will be charged at the rate set out in your Agreement for cash advances and balance transfers starting on the first day of the statement period after your missed payment. For a Low Rate Card the current cash advance and balance transfer cash advance interest rate is 12.99% and for a No Fee/Low Fee/Gold/Platinum/World Elite card the current cash advance and balance transfer interest rate is 25.99%.